You’ve heard this before, right? Or, some variation?

”They were the wrong employee.”

“I picked the wrong distribution partner.”

“My VC is destroying my company.”

“My supplier just screwed me.”

How could you have known that this was going to happen? Profiling and patterns of behaviour, of course.

In a world where we have tons of information and data, why is it that we can’t seem to get it right when it comes to parsing through things to separate the wheat from the chaff?

For instance, in post on Twitter, Jeffrey Silverman shared this:

Of course, I was intrigued and wanted more context.

The Zebra never changes its stripes… how interesting. Further to that point, as was recently picked up in Fortune magazine:

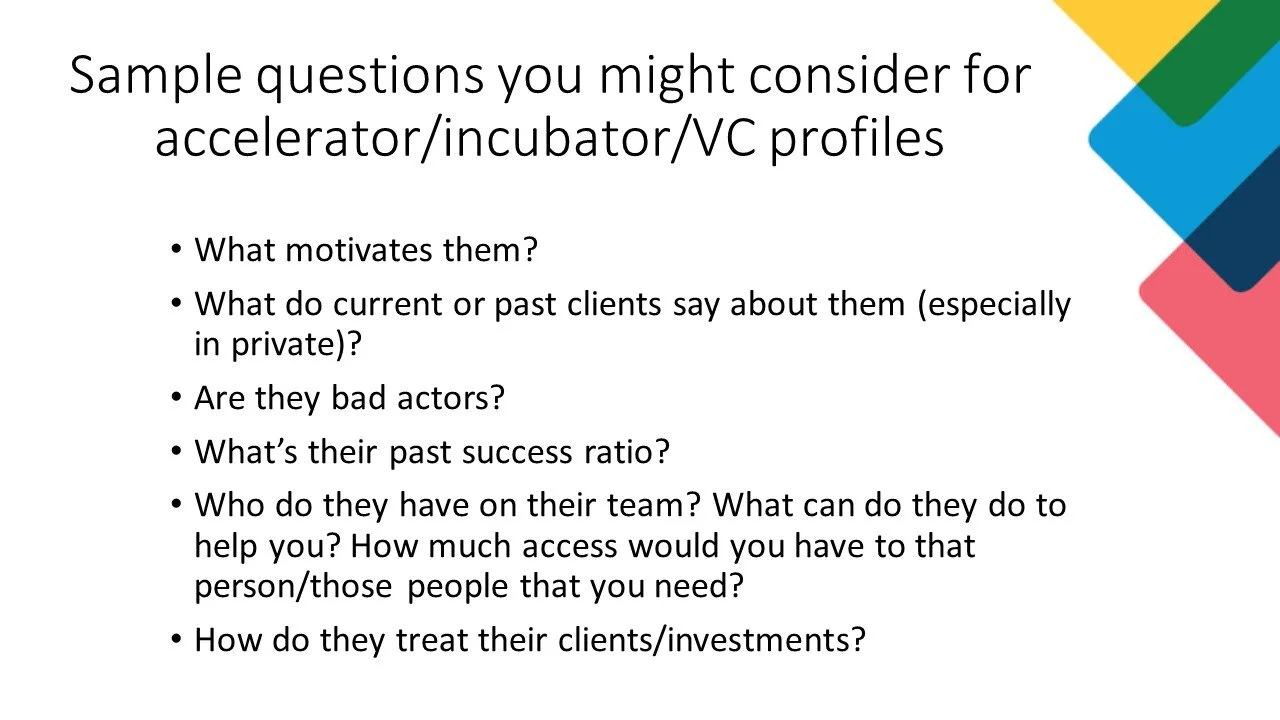

Yet another example that I heard of recently was scarily similar to what Jeffrey mentioned above, wherein a company had gone through an accelerator, only to have the accelerator rip off their tech and build out a competing product. Again, bad behaviour.

Yet, profiling someone or a company isn’t all about bad behaviour: it’s about understanding how you can be successful with your interactions, whatever your goals are.

Tell me about your best friend

If I told you, “go do a profile for your next sales call”, you may or may not know how to do that, right? If that feels a bit challenging, let’s try an exercise: tell me about your best friend.

What are they like?

What do they do every day?

What are they consistent about?

What do they never do?

How do they speak?

What do they do under stress?

I’m sure you’re getting the picture: you could probably describe them for an hour, right?

Maybe you’ve had moments, like me, where you’ll say, “that doesn’t sound like them” about your best friend or someone close to you. When you make statements like that, you’re probably right. Or, they’re under some sort of stress that is making them act out of character.

Profiling a person is like that: you need to understand people at a deep level to understand what they do and why.

Profiling a person or a company (which is assembling the profiles of multiple people and contextualizing things within the organizational behaviour pattern) can be immensely helpful for activities like:

Sales

Product Development

Mergers and Acquisitions

Negotiations (of all kinds)

Marketing

Hiring and HR

How do you do it?

While there are many advanced methodologies, if you’re just starting your journey to conducting profiles, think about the following:

What are your goals for the exercise? This can change things significantly. If you want to sell something to a customer, as an example, that approach and the key insights you’ll need will be different than if you’re looking to inform your product development.

What do you know? Talking to people that know the person you are profiling (you sometimes have to be careful doing this, of course), common friends/contacts, internal staff, and then using secondary sources to help paint the picture of what you know about this person is important.

What don’t you know? This can be equally as important. Sometimes, you may have large gaps of information. Sometimes, the gaps can be telling: they may put all kinds of things on the internet (or even talk about it in conversation), but have some NEVERs (and it’s vital you understand if there are cultural reasons in play here: maybe it’s family, maybe it’s money, religion, or some other area. You have to look to understand what are the NEVER approach topics, and WHY they are such.

You may also have to “profile on the fly”, which may not be the optimal approach, but sometimes, you do what you must. You might be at a trade show (online or in-person), as an example, and have someone come up to you and not have time to do a full profile. Elicitation can be a great way to do this, but, if you’re not sure how to do this, engaging an expert to help you may be a much better approach.

You can also look to ask “check questions”: those are the, “If I ask these specific questions, I can quickly determine what I need to know about the intent of this person.”

Things to consider

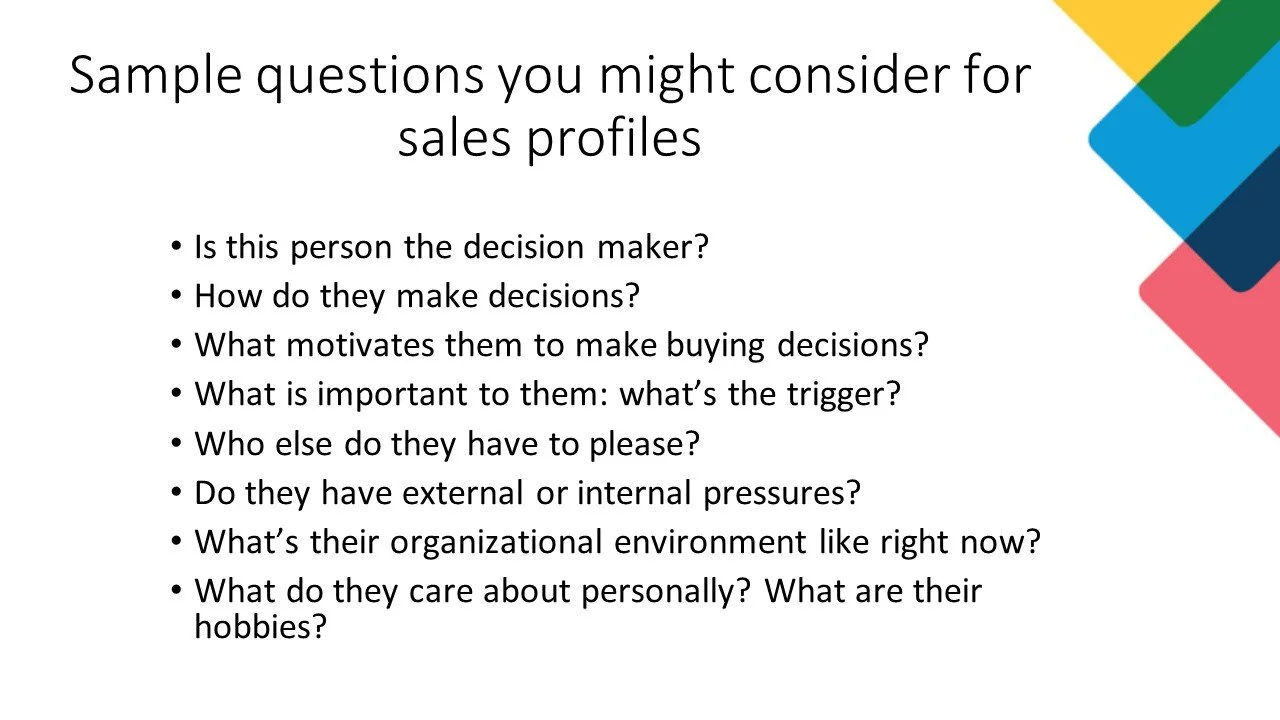

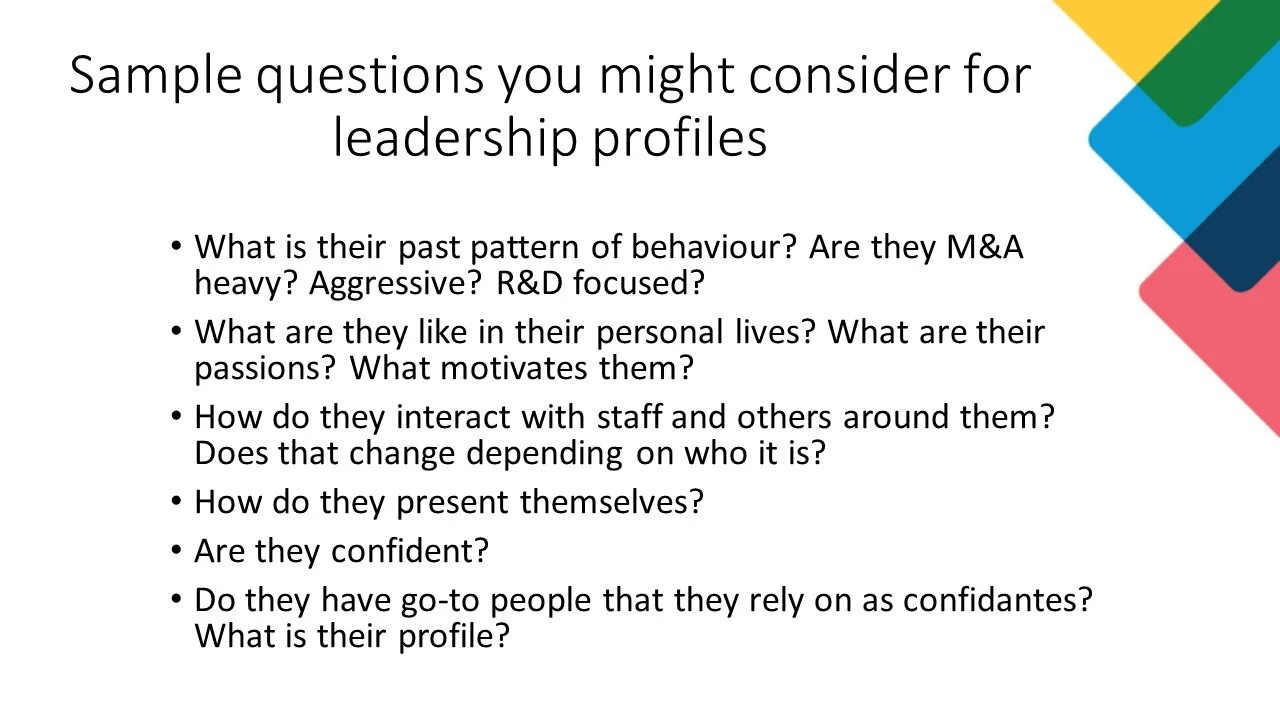

To help you out, we’ve put together some sample considerations you might think about when you’re profiling. This is not meant to be exhaustive, nor proscriptive, but it should give ideas on where you can start to consider a profile.

Final tips

I’ve done lots of profiles since I started working in competitive intelligence and market insights … Here are a few questions to keep in mind:

Does this help me? Or, could I use this information somehow? Is this helping me accomplish my goals? If not, move on from it.

Am I being mislead? Some firms use what is called counter intelligence to lead you astray. Always corroborate your information. Look for signals and indicators.

What is the best source to get this information? If there is a sensitive topic (maybe you’re trying to get insights on the competitor’s next move, as an example), you may not want to ask the competitor CEO. So, who else might know? Suppliers? Customers?

Always conduct yourself ethically. Competitive intelligence and market insights is NOT spying.

Additional resources:

Did I miss anything? Please feel free to send suggestions. If you liked this blog and this type of content, join my monthly email, Strategy and CI, where we focus on helping you make better decisions.